Estate Planning Lawyer Bloomington IL

Estate Planning Lawyer Bloomington IL Explains Importance of Drafting Estate Plans. Pioletti Pioletti & Nichols, an estate planning lawyer Bloomington IL residents can count on, has been offering legal assistance for 79 years. As a family-run law firm, we help clients take proactive steps to ease tax burdens through estate planning and legal trusts. Estate planning not only includes the creation of wills; it also protects assets and asset owners who may be susceptible to financial or physical abuse.

Many clients reach out to an estate planning lawyer in Bloomington, IL, for help with developing plans that outline the elements of their life when the time comes that they are unable to make decisions on their own. While creating an estate plan can seem overwhelming for some, the process can be pretty straightforward with a law firm like Pioletti Pioletti & Nichols. Once the estate plan is executed, there will be a few key steps executors must take. An executor should make sure that they prepare their family by communicating their wishes to them; they also must update their plan accordingly. While the life cycle of the estate plan may seem burdensome, it’s possible to gain peace of mind with a well-developed and updated estate plan with guidance from our firm.

Elements of an Estate Plan

An estate plan encompasses crucial documents that outline a person’s wishes when the time comes that they are unable to make decisions on their own. These documents indicate how the executor would like to be cared for and how their assets will be distributed after their passing. These plans are significant because they ensure that there is no question as to how the executor would like their estate to be managed. These fundamental elements may include:

- The Will

- Beneficiary Designations

- Power of Attorney

- Healthcare Directives

- Guardianship Designations

- Funeral Arrangements

- Trusts

There are several options that executors have when developing an estate plan. However, it’s important to know that serious issues may arise for all who are involved without one. An estate planning lawyer in Bloomington, Illinois, can help prevent complications by listening to the needs of their clients and clearly outlining their wishes.

Updating the Estate Plan

Once the estate plan is created, it can’t be left to sit and gather dust. Executors must update these documents over time. As circumstances change, the estate plan should reflect these changes. It’s only natural that a person will experience many changes throughout their lifetime. Failure to update the estate plan to reflect these changes can be detrimental, leaving the estate plan so painstakingly created useless. Executors should update an estate plan at least every 3-5 years or when they:

- Accumulate additional wealth

- Give birth or adopt children

- Marry or divorce

- Purchase property

- Change jobs

- Move out of state

Life changes almost always constitute an update of a person’s estate plan. An out-of-date plan can result in severe issues as guardianship designations, and beneficiary allocations may no longer be valid. However, when these are left to sit without updates, the executor risks decisions being made by loved ones that no longer reflect the executor’s wishes.

Communicating the Estate Plan to Family

Once the estate plan has been created, additional legwork must be done. The executor must communicate their wishes to loved ones. While an estate plan will outline critical decisions when a person is no longer able to make decisions on their own, sharing these wishes with family and beneficiaries is one of the most crucial next steps that should be taken. When families are unaware of who will care for children, how assets will be distributed, and how the executor would like to be cared for should they become incapacitated, familial conflict can follow. Families will have their ideas of how their loved ones would have wanted decisions made. Even when there is an estate plan, it can be difficult for them to wrap their heads around the next steps. When these plans are clearly outlined and communicated, an estate plan may mitigate the risk of conflict within the family. When these wishes are discussed ahead of time, loved ones can ask questions and come to terms with the decisions that have been made. As a result, familial conflict and will contests are mitigated, which can take a significant load off of family members who are grieving such a loss.

A Dedicated Bloomington Estate Planning Lawyer

An estate planning lawyer Bloomington IL respects from Pioletti Pioletti & Nichols may handle all aspects of your case. Our law firm serves as an advocate and resource to those who might have concerns about the protection and distribution of their wealth and assets. We understand the complexities and laws associated with estate planning, and we remain committed to preventing unnecessary catastrophes. Guided by this willful determination, we build long-term relationships with our clients.

Understanding Estate Planning

A basic estate plan typically consists of a last will and testament, a power of attorney, and a living will. These three documents form the basic building blocks of a proper estate plan. They facilitate the proper administration of a person’s estate while they are living but unable to make decisions for themselves. They also provide for the basic disposition of a person’s assets after their death. For many people, this is the extent of their estate planning needs.

Some people require a more complex estate plan including the use of trusts. If you’re unsure, an estate planning lawyer in Bloomington IL may help you determine which plan is ideal for your situation.

Will and Trust Preparation Attorney

Traditionally estate planning has been viewed as dealing with the disposition of property after death, however, it encompasses much more. It is a dynamic process that takes into account personal and family goals throughout a client’s lifetime as well as after their death. The attorneys at Pioletti Pioletti & Nichols take time to understand your unique situation. Together we may decide which instrument best serves your needs, the needs of your beneficiaries, and the needs of charitable organizations you are connected to.

There are many ways to dispose of your property through the use of wills and trusts. We may talk you through the advantages and disadvantages of every option available to you. Our attorneys may also provide experienced counsel as to the best option to execute your desires. Our representation includes:

- Wills and trusts

- Life insurance trusts

- Power of attorneys

- Advanced health care directives

- Elective share planning

- Creditor’s claims

- Fiduciary litigation

- Trust contests

- Special needs trusts

- Guardianships

If you need assistance with any of the aforementioned, you may want to contact an estate planning lawyer Bloomington IL families can count on.

Why You Should Start Your Estate Planning Today

Terms such as “estate” and “last will” may seem daunting, especially for young people (who often haven’t thought as much about their mortality or long-term wealth management), but they really aren’t anything to be nervous about. At some point, everyone will need to consider their estate and make decisions about what should happen in the event that they pass away. There are several reasons why you shouldn’t wait to start your estate planning, even if you think you’re too young.

Protection for Your Family

While obvious, the most basic reason not to put off this kind of planning is to protect and provide for your family. Even if you think you don’t have enough wealth or assets to really make a difference, it should be your top priority to make sure that things are ordered in such a way that your spouse, children or other family members receive what they ought to receive if something happens to you. Bank accounts, investments, property and other assets should all be covered in this process. Some of these considerations can get complicated, so it’s always a good idea to hire an estate planning lawyer in Bloomington, IL, such as Pioletti Pioletti & Nichols, to help you tackle it and do it right. The last thing you want is to leave your estate (and perhaps your family) vulnerable simply because you neglected to be thorough and get the help you needed!

Peace of Mind

On a similar note, getting your estate planning done (or at least a first draft of it to get started) will give you great peace of mind from day to day. Even if you’re young, the uncertainty of what will happen if you pass early can become a nagging stresser that builds up over time. Give yourself the gift of peace by getting it done. And remember, it’s okay if it feels overwhelming; just be sure to reach out to an estate planning lawyer in Bloomington, IL, to help you, such as Pioletti Pioletti & Nichols.

Motivation

Finally, a great benefit of organizing your estate is that it helps you to take stock of where you are financially and where you want to be ten, twenty or more years from now. Even the act of planning your estate will help to give you a better appreciation for the financial and other blessings you’ve been given, and out of that appreciation you can find motivation to keep saving handling your wealth well for the sake of your loved ones.

Don’t be afraid to start tackling your estate planning today. After all, being prepared for whatever happens can pay dividends for both you and your family for generations to come!

FAQs About Living Trusts

What Is the Difference Between a Living Trust and a Will?

A living trust is a vehicle for managing only the assets you put inside it. It’s going to exist while you live and after you die. A will provides for what happens to your assets after you die, and only goes into effect at that time.

What Are the Benefits of a Living Trust?

The biggest advantage to a living trust is that it allows your assets to skip the lengthy, costly probate process. A living trust can also hold assets, for example, if you want your children to receive money on their 25th, 30th and 35th birthdays, you can set up your trust to do that. Your estate planning lawyer in Bloomington IL, from Pioletti Pioletti & Nichols can explain more benefits of a living trust to you.

What Are the Drawbacks of a Living Trust?

Not all of your assets may be owned by the trust. These include life insurance policies and some retirement accounts. If you forget to retitle your assets such as bank accounts, vehicles and your home into the name of the trust, they may still have to go through probate. If you rely solely on a trust, without a will, any assets left out of the trust will be disbursed to your heirs according to state law. Setting up a living trust can also feel prohibitively expensive.

Who Should Be Your Trustee?

Many people choose themselves to be the trustee of their living trust. This allows them to control their assets during their lifetime. However, they can also name friends, relatives or law firms as their trustee. If you name yourself the trustee, an estate planning lawyer in Bloomington IL may advise you to choose at least one backup trustee to take over when you die.

Should You Also Have a Will?

You should definitely have a will. Many times, an estate planning lawyer in Bloomington IL, might advise a “pour over will,” which directs assets to pour over into the trust after your death. This protects all your assets from probate. Your Pioletti Pioletti & Nichols attorney can help you draft the right will for your particular situation.

Do You Still Need a Power of Attorney?

Even if you name someone else as the trustee of your living trust, you should also draft a power of attorney, giving someone the legal right to handle your finances for you in the event you’re incapacitated due to illness or injury. These two people can be the same person for simplicity’s sake.

Estate Planning Lawyer Bloomington IL Trust Discusses the Role of the Executor

As you and an estate planning lawyer draw up a trust, will, or estate plan, there will be a time in which you must choose an executor. This should not be immediately decided as it is a role that requires care, attention, honesty, and trust. On the other hand, if you are being asked to become the executor of a trust, you should take some time to think about what will be expected of you.

To speak immediately with a Bloomington IL estate planning lawyer about assigning an executor, please call Pioletti Pioletti & Nichols. We have been helping people draft estate plans of every kind and complexity. Regardless of what your needs might be, we can help.

What is the role of an executor?

An executor of an estate oversees the disposition of property and possessions. For some, the role of an executor is an honor. For others, this role is particularly scary. The executor of an estate has a duty to ensure the deceased person’s last wishes are granted with respect to the distribution of their personal assets. In addition to this task, an executor must make sure that all debts and taxes are paid with the remainder being distributed to the right beneficiaries.

An executor does not have to be a legal expert; however, an estate planning lawyer would advise you that he or she be honest, trustworthy, mature, and diligent. An executor is not entitled to any proceeds from the sale of property or assets of the estate. They may receive compensation for administering it once everything has been completed. Usually, a lawyer will hold this compensation and pass it onto the executor at the right time.

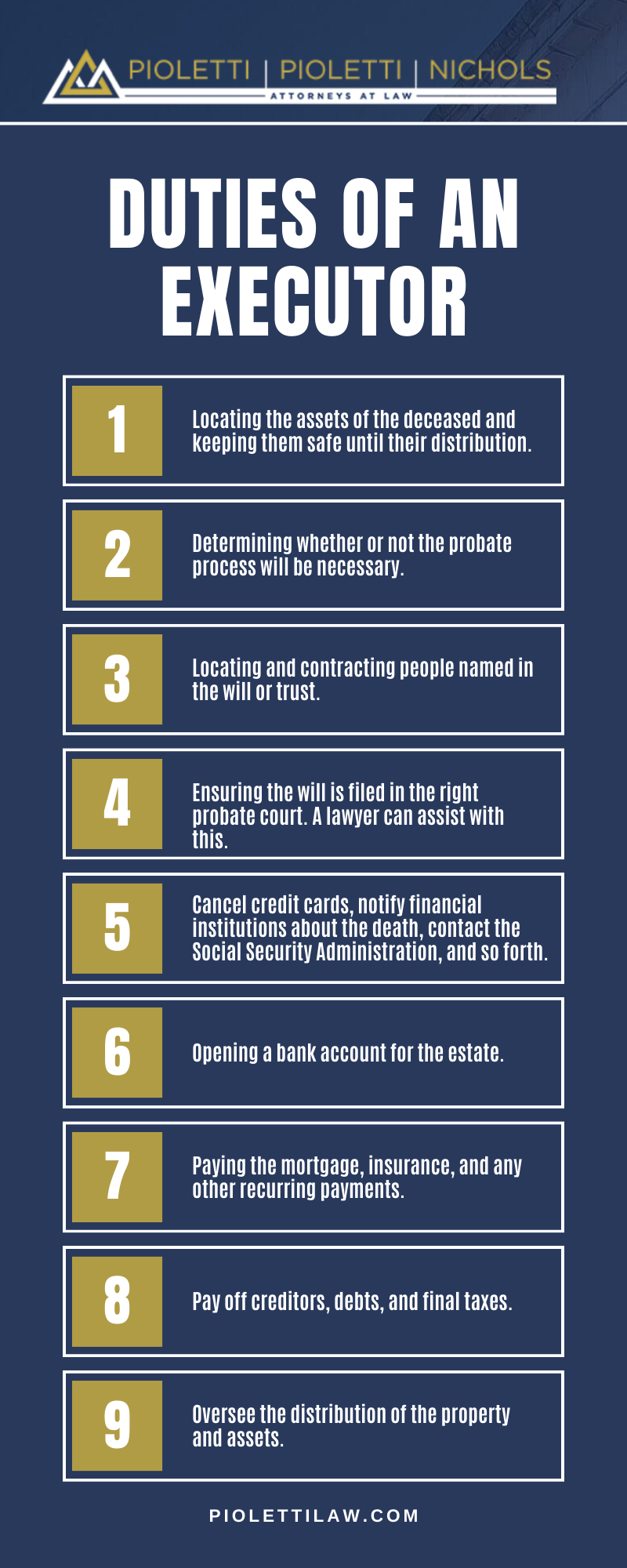

Duties of an Executor

An executor of an estate will have many duties to fulfill. Some of these include:

- Locating the assets of the deceased and keeping them safe until their distribution.

- Determining whether or not the probate process will be necessary.

- Locating and contracting people named in the will or trust.

- Ensuring the will is filed in the right probate court. A lawyer can assist with this.

- Cancel credit cards, notify financial institutions about the death, contact the Social Security Administration, and so forth.

- Opening a bank account for the estate.

- Paying the mortgage, insurance, and any other recurring payments.

- Pay off creditors, debts, and final taxes.

- Oversee the distribution of the property and assets.

Depending on how large the estate is, there could be several other duties for an executor to perform. Before naming an executor for your own estate you should make sure he or she will be able to handle the tasks you are assigning to him or her.

Estate Planning Infographic

How To Choose an Executor

It’s always a good idea to name an executor when drafting your will and sometimes it is even beneficial to name a backup executor in case your first choice declines or is unable to fulfill the role. An estate planning lawyer in Bloomington, IL can help you determine who might be the best option to serve as the executor of your will.

Choose Someone Trustworthy

An executor can be chosen from friends, family, or professionals, but you want to make sure that you can fully trust this person. They will be responsible for completing the distribution of the assets you have left behind. An executor can also be included as a beneficiary in your will. However, if you feel that any of your wishes might be difficult to carry out it might be easier for your beneficiaries to see a third party serve as the executor of your estate. Pioletti Pioletti & Nichols is a trusted estate planning lawyer in Bloomington, IL that can help you decide who might be the most trustworthy executor for your estate.

Choose Someone Good With Details

Since executors are responsible for a wide array of tasks such as relieving unpaid debts, canceling bank and credit card accounts, contacting all institutions and notifying them of your death, as well as distributing all the assets, it is imperative that you have someone who has administrative strengths. Pioletti Pioletti & Nichols recommends you choose someone with the ability to pay attention to detail and to see tasks through to completion. Individuals with these characteristics are the best options to fulfill the role of an executor.

Choose Someone Steady

As you are meeting with your estate planning lawyer in Bloomington, IL you may come to understand that you need to choose an executor who will be of stable mind after your passing. You want to consider the fact that many people will be mourning your loss and might have a difficult time coping with your death. It’s best to choose someone who feels they will be ready and able to complete the tasks at hand, even while grieving. For some people, having to sort through all the paperwork and other work involved would be too much of a burden during an already emotionally taxing time.

The executor of your will has an important role as the person who will carry out your wishes regarding your estate after your passing. It’s important to consider these few points while determining who might be best suited to serve as your executor.

Talk with an Estate Planning Lawyer for Personal Legal Advice

Planning out your estate is no easy task. Furthermore, it has to be accurate and legally stand in a court of law. Even one wrong word could lead to serious complications. To avoid this, you should consult with an estate planning lawyer Bloomington IL clients recommend who can help you to draft a legally binding will, trust, and estate plan.

Schedule a Free Consultation with an Estate Planning Lawyer Bloomington IL Residents Deserve

Estate planning is crucial to the protection of your wealth and assets. Without it, you risk lengthy court battles and legal matters which could cause a serious disruption in your life. To prevent this from happening, you’ll want to consider talking to the lawyers at Pioletti Pioletti & Nichols. For a free consultation with an estate planning lawyer Bloomington IL trusts, please call our office today.

Common Questions Regarding Beneficiary Designations for Estate Planning

Are you in the process of developing your estate plan? One consideration to bear in mind is the importance of making sure that you have designated beneficiaries on all accounts that allow you to do so. Beneficiary designations may seem like a fleeting thought but, they are critical for a variety of reasons. A Bloomington IL estate planning lawyer can help you by developing an estate plan and in making sure that all of your accounts have both primary and contingent or secondary beneficiary designations.

What are beneficiary designations?

Some accounts that you may have, provide you with the ability to choose who will inherit assets when you pass away. Beneficiary designations are a way of being able to identify the person who will benefit from your assets. In some cases, you may have the ability to choose more than one primary beneficiary. Should you name multiple people, your assets will be divided equally amongst them. Some accounts that are likely to allow for beneficiary designations include:

- Retirement accounts

- Investment accounts

- Checking accounts

- Life insurance policies

What is a contingent beneficiary designation?

Once you have made beneficiary designations, you are not completely done with the process. You will then need to name a secondary or contingent beneficiary designation. This is the person who may inherit your assets if the original person you designated has passed away.

Do accounts with beneficiary designations go through probate?

In most cases, accounts that have a beneficiary designation are not required to go through the probate process. As an estate planning lawyer in Bloomington IL can explain, beneficiary designations on accounts often override anything you have outlined in your will. Because of this, it’s important that you keep these designations up-to-date to ensure that assets go to the correct person should you pass away. Avoiding the probate process is beneficial because it allows your beneficiaries to gain access to accounts in a timely manner.

How often should I review or update accounts with beneficiary designations?

Keeping beneficiary designations up to date can ensure that your assets do not fall into the wrong hands. Regularly update them with the assistance of your Bloomington IL estate planning lawyer, especially when you experience life changes such as:

- Marriage

- Divorce

- Birth of children

Making sure that you have kept your beneficiaries updated can help reduce the risk of family conflict should you pass away. Beneficiary designations can provide for a seamless transfer process to beneficiaries, especially if you keep these designations updated.

What happens if I did not designate beneficiaries on my accounts?

If your beneficiaries are outdated or you have failed to make beneficiary designations, you will not have the ability to choose who should inherit these assets in the event of your passing. Should this occur, your benefits or assets will become part of your estate. As a result, assets from accounts that may have been protected from probate may become a part of proceedings. When assets go through probate they may be subject to estate taxes and utilized as payment towards your debts before they can be distributed to heirs. It could be a significant period of time before a beneficiary is even able to obtain their inheritance.

It’s important to understand beneficiary designations in addition to making sure they are regularly reviewed. Without the proper designations, your accounts may be subject to probate, which could impact the inheritance of your loved ones. Speak with an estate planning lawyer Bloomington IL clients trust from Pioletti Pioletti & Nichols to ensure that you have an estate plan and beneficiary designations complete for when the time comes.

Estate Planning Lawyer Bloomington IL

You may be surprised and delighted to find when it comes time for you to plan exactly how you want your estate distributed you can find an outstanding estate planning lawyer right here in Bloomington IL.

If you’re like many people, your estate plan may be fairly straight forward and include these three basic documents: a last will and testament, a power of attorney, and a living will. Taken together, you have the basic foundation of a simple yet solid estate plan. They actually can help you make sure the proper administration of your estate can take place either after your death or in the event you become incapacitated and unable to make decisions for yourself before you pass. These papers, properly drawn by an attorney practiced in estate planning let’s you make sure your assets are distributed according to your desires when the time comes.

Of course, your situation and assets may be more complex and require an estate plan with more elements. A local estate planning lawyer here in Bloomington IL will help you understand your options, including, for example, the proper use of a variety of trusts. If some of your assets are owned jointly with another, the attorney will help you sort that out so your wishes are met. All the forms needed will be available and you won’t have to worry about skipping something. The goal is to make sure your needs and wishes are met.

Estate planning is really about you having a say about to whom and how your assets are to be distributed after you die. The value of your assets may be more than you realize. Of course they include the obvious, like your home, any second home, your vehicles, including boats and antique cars. You may own stocks and bonds or perhaps a stamp collection you started in your youth that has acquired way more value than you know about. Properly done, an estate plan will help you know the real worth what you’re leaving behind. It may also protect those assets from loosing significant value to taxes of various sorts. With the help of an attorney who understands the various laws that govern your estate, your plan can often avoid the delay and cost of probate. Estate planning may also significantly reduce the stress your heirs may feel when it comes time to figure out who gets what. You’ve done it for them.

Planning your estate often lets you not only acknowledge your obvious heirs like family members and people who have been truly significant in your life, but means you can also contribute to institutions like an alma mater or an art museum or a zoo or a private school. You probably have more options than you know.

Working with an estate planning lawyer in Bloomington IL can bring you real peace of mind. You’ll be working with a professional who understands estate law so you can be sure the property you worked so hard to acquire goes exactly to the people and institutions of your choice. You’re leaving little to chance which can be a good feeling indeed.

You can find out more at our website or by calling 309-364-6758. When you call you’ll speak to a real person, 24/7.

Estate Planning Lawyer Bloomington IL

The prospect of finding an estate planning lawyer in Bloomington IL doesn’t have to be a daunting one. If you have a clear plan about what you want in your lawyer then the process can be simpler than you think. Just by having a clear plan you can make the process smoother and you won’t be looking for a lawyer for ages if you know what you want already.

However, if you are stuck on how to do that, we have a list on how to get yourself ready to find the right lawyer for your needs. Here are the three main steps that help you streamline the process of finding the right lawyer for you.

- Search for Candidates

This sounds simple and it can be, but if you don’t know how to search then you could be stuck here. The first step is to figure out what you need to accomplish with your estate plan. That information will help you determine the type of lawyer you will need.

In most cases, you will need a generalist who can help you draft up a will, powers of attorney, and basic trusts. However, there are situations that call for lawyers with specializations. If you are concerned about maximizing benefits such as Medicaid or addressing long-term care then you would need someone who specializes in elder law. If you have financial assets overseas then you would need someone who specializes in international estate planning.

Once you know what kind of lawyer you need, you can start to build a list of candidates. Start by asking trusted friends and family. Then ask your place of work. If all else fails, searching online can help you find qualified candidates.

- Interview the Prospects

Once you’ve narrowed down your list to your top candidates it is time to talk to them about an interview. Most lawyers offer a free consultation which is what you should use to start your interview. Treat this like a job interview as they will be working with you to provide a service. You need to come prepared with what you want out of estate planning and a list of questions. Here are some of the questions that you should be asking during your interview:

- How long have you been practicing?

- What is your communication style like?

- How often should I expect communication to be?

- What is the best way to contact you?

- How much of your experience is in estate planning?

- What is your rate?

- Will you send me updates about the status of my plan or should I take initiative?

- Who will be handling the majority of the planning?

Trust your instincts when it comes to finding a lawyer. If you don’t mesh well with them in the interview then move on and find someone that you get along with.

Finding a lawyer doesn’t have to be daunting. If you want to know more about what Pioletti Pioletti & Nichols can do for you when it comes to an estate planning lawyer in Bloomington. IL then don’t hesitate to reach out today.

No Estate Plan? Understand the Impact of What Could Happen

An estate planning lawyer in Bloomington, IL, is an asset for those who need to develop or update their estate plans. Estate planning is an essential tool for anyone with assets that beneficiaries stand to inherit and minor children who will require a plan when you pass. Putting off the estate planning process has many disadvantages should something happen to you before you have a chance to put a plan in place. As a result, the decedent loses their voice and opportunity to outline what their wishes would have been. Additionally, without Pioletti, Pioletti & Nichols to support, there may be potential implications on the inheritance loved ones stand to receive. Without a will or estate plan in place, families are ripe for conflict as amidst their grief, every one of them may have a different understanding of what your wishes may have been. It’s essential to mitigate these issues by not hesitating another moment with developing an estate plan.

Lose Your Voice

Chances are you have some idea of what you would like to happen should you become incapacitated or pass away. When you fail to complete an estate plan, you lose the ability to make these critical decisions. This stems far beyond how assets are distributed to beneficiaries. While estate taxes aren’t necessarily higher for someone who has passed away without a will, with no plan, and no beneficiary designations, most assets will pass through probate, which could deplete the inheritance of beneficiaries. It’s also important to note that an estate plan doesn’t just determine the distribution of assets; it also contains decisions regarding who will make decisions for you, who will care for your children, and how you would like to be cared for in the event of incapacitation.

Dying Intestate

When a person passes away without a will or estate plan, it means they have died intestate, and there is no plan left to outline the distribution of assets. Our Bloomington, Illinois estate planning lawyer shares that, typically, when a person passes away, the probate court must validate the will before debts are paid, and assets are ultimately distributed. However, there is no plan for the court to refer to when someone dies intestate. As a result, the judge presiding over the case will make decisions in accordance with the laws of succession in the state of Illinois. This can be challenging for families and loved ones, especially when minor children are involved.

Familial Conflict

Dealing with the loss of a loved one is a heavy load to carry. At times, grief-stricken families can make decisions fueled by their emotions. When someone passes away, the possibility of familial conflict is not far away. When a person passes away without a will, it’s almost a given that family will be in disagreement over crucial decisions. Lack of a will can completely dismantle families. Developing an estate plan and sharing your wishes with loved ones makes this issue possible to prevent.

Whether you do not believe you require an estate plan or just haven’t gotten around to developing these essential documents, it’s time to start putting off this vital process. With guidance from a firm like Pioletti, Pioletti, & Nichols, you have the opportunity to outline your wishes clearly. To get started, contact our Bloomington, IL estate planning lawyer.

If you want to set up an estate plan, you may want to consult an estate planning lawyer in Bloomington, IL from Pioletti Pioletti & Nichols. Estate planning can be quite complex, so it’s wise to have someone knowledgeable and experienced on your side. Here are the most frequently asked questions and answers about estate planning.

What Is Included in My Estate?

Your estate holds all of your real property, personal property and other assets. This may consist of homes, stocks, bank accounts, vehicles, retirement accounts and furniture.

What Is a Will?

A will is one of the most basic estate planning documents that lets you designate how your property will be distributed after you die. The document also states your other wishes, such as the type of funeral you want and who you want to look after your minor children. A will should include the names of your beneficiaries, who will receive your property after your death, and an executor, who will manage your assets after your death.

Who Needs Estate Planning?

Estate planning is no longer for just the ultra wealthy. Nowadays, people of all ages and economic backgrounds can benefit from having a solid estate plan in place. This way, the people you want to inherit your assets will receive them upon your death.

What Is Probate?

Probate is the legal process of distributing a deceased person’s assets according to his or her will. When the executor of the will has started the probate process, he or she will pay the decedent’s debts and then distribute the remaining assets to the named beneficiaries.

Do I Need an Estate Planning Lawyer?

While you are not legally required to hire an estate planning lawyer in Bloomington, IL, it is in your best interest to do so. A lawyer can ensure that your estate plan says what you want it to and is enforceable in court.

Do I Have to Leave My Property Equally Among My Children?

No, you are under no obligation to give all your children equal inheritances. Sometimes it makes more sense to give some of your children bigger inheritances than the others. For example, if one of your children isn’t as financially secure as the others, you may consider giving him or her a larger inheritance.

If you need assistance with your estate plan, schedule a consultation with an estate planning lawyer in Bloomington, IL today.

Estate Planning Lawyer Bloomington, IL

If you are looking to start estate planning then is important that you look for an estate planning lawyer in Bloomington, IL to help you through this. Estate planning is an excellent arrangement when repaired correctly to assure your asset safety. However, when he startled look for an estate planning lawyer you shouldn’t just settle for the first one that you meet.

You need to be diligent and consider all your options to form a robust estate plan without any loopholes. This means that you should know the top qualities that make a great estate planning lawyer. This way you can find the right lawyer for you and your needs.

What Are the Top Qualities of a Great Estate Planning Lawyer?

If you’ve never had to look for a lawyer may not know what makes a good estate planning lawyer. In order to help you in your search, we compiled a list of qualities that any good estate planning lawyer should have. Here are the qualities that any estate planning lawyer should have in order to be worth your time:

Knowledgeable

Your estate planning lawyer should know the terminologies related to estate planning. It sounds simple enough but these terminologies can be baffling for those who are experienced. They should also know all the methods that are used in these legal procedures. Not only that but they should be able to explain these procedures to you clearly and in a way that you’re going to understand. Just like with any profession that is specialties, and you need someone to understand estate planning.

Provides All Estate Planning Tools

Planning in the state requires various tools. Your lawyer should be able to offer you all the tools that you will need to be reduced taxes, increase profits, and keep your assets protected until they are ready to be inherited. If your estate planning lawyer is unable to do this to help you then you should look for a different estate planning lawyer.

Punctual

A genuine estate planning lawyer should be punctual. They should also respect your time as well as their own. Estate planning can happen at any age and this means sometimes there is a strict deadline. A draft of an estate plan is to be ready within a couple of weeks and the final draft should be ready and no more than a few months. If your estate plan is seeking longer than that then it could mean that the lawyer has too many clients on their hands at once.

Good Communicator

Your estate planning lawyers going to require multiple details from you regarding your family and your business. They’re going to have to ask a variety of questions to help the documentation process. If you do understand these questions we feel like you are being listened to and chances are that this isn’t the right estate planning lawyer for you. Not only should that be a good communicator should also be a good listener.

There are many people who do not realize how important it is to have a solid estate plan in place. They may think that this is something only elderly people need to do, or they may just feel uncomfortable thinking about their own mortality. Whatever the reason, the truth is that not having certain elements in place can have a significant negative impact on your assets, especially if certain circumstances arise.

At Pioletti Pioletti & Nichols Law Firm, we understand why our clients may hesitate at planning for the future when they are no longer here for their loved ones and are dedicated to ensuring that the estate planning and asset protection process is as comfortable as possible. To find out more, contact our office to meet with an estate planning lawyer to discuss how we can help you.

Life Events

A Bloomington IL estate planning lawyer often finds that although our clients may have their assets in insured and government protected accounts, there are other risks that can threaten those assets they are not even aware of. Some of the life events that occur which can have negative impacts on assets include the following:

End of a Marriage

One of the most common life events that people go through which can do significant damage to a person’s financial standing is divorce. Many couples get married and then combine their income during the years of their marriage. This often includes any inheritance that either of the spouses may receive. This is referred to as comingling of assets. When this occurs, the assets are no longer considered separate property but becomes part of the marital estate and both spouses and must be fairly distributed should the couple divorce.

It is not uncommon for our clients to be working on their estate plans with one of our attorneys and to express concern that their adult child’s marriage is on shaky ground and they are concerned about what will happen to any assets they bequeath to their child in the future. They worry that the inheritance will become part of the divorce settlement and go to the future ex-daughter- or son-in-law.

There are steps that your estate planning lawyer can take on your behalf to ensure that should any of your heirs go through a divorce, any inheritance you leave them will be protected.

Remarriage

Although it is not something couples really want to think about, the reality is that when one spouse dies, it is common for their widow or widower to eventually remarry someone else. Although many people express that they would want their spouse to move on with their life and be happy with someone else, there could be and should be concern that any assets they have do not end up benefiting that future spouse should the widow or widower pass away during that marriage.

The main concern is that all the assets would pass to that future spouse. This could also occur if the marriage ends in divorce. Your estate planning lawyer can set up your estate plan to make sure this does not happen and that any assets you and your spouse have would bypass his or her future spouse and go to your children or anyone else you designate as beneficiary.

Lack of Trust in Beneficiary or Heirs

Every family has their issues and many of our clients have come to us concerned that the very people they love and want to make sure are taken care of when they are gone are people they do not trust to make smart decisions about any assets that they inherit. For example, an adult child who has a substance abuse or gambling problem could very well spend their inheritance foolishly and quickly blow through the entire amount. An estate planning lawyer Bloomington IL clients recommend can explain how easily you can implement safeguards against this, while still making sure your loved one will be taken care. In the meantime, here are some common questions our clients ask:

FAQ: What does an estate planning lawyer do?

An estate planning lawyer Bloomington IL residents trust may be able to assist you in creating plans for your assets and future needs, if you should die or become incapacitated. At Pioletti Pioletti & Nichols, our lawyers work diligently to follow your goals and desires for your estate and other property. Selecting an estate planning lawyer in Bloomington IL you can depend on may help you provide for the future of your loved ones.

FAQ: Is estate planning the same thing as writing a will?

A will is only a small, yet important part of creating an estate plan. A will does not affect all assets and is used after you have passed away. A thorough estate plan will include a living trust, and plans if you become incapacitated, in addition to a will. An estate planning lawyer Bloomington IL residents turn to from Pioletti Pioletti & Nichols Law Firm, may help to develop an estate plan that is specific to your situation.

FAQ: What should I include in an estate planning inventory?

An estate planning lawyer Bloomington IL residents have worked with, will suggest putting together a comprehensive list of everything you own. This includes:

- Physical Assets: Your home, real estate, cars, jewelry, artwork, etc.

- Write down all insurance policies you have.

- Create a list of liabilities you have such as mortgages, line of credit, and other forms of debt.

- Gather statements from your bank, brokerage, and retirement accounts.

FAQ: What is the difference between a will and a trust?

A will goes into effect only after you have passed away. It is a document that directs who will receive your property and assets and appoints a legal representative to carry out your wishes. A trust, on the other hand, takes effect as soon as it is created. In a trust, the third party, or trustee, holds assets on behalf of a beneficiary. Choosing an estate planning lawyer Bloomington IL residents trust should be taken into account when determining a trustee.

FAQ: Why is it important to hire an estate planning lawyer?

Estate planning can involve many complexities and it’s beneficial to have an experienced estate planning lawyer Bloomington IL trusts on your side. A lawyer may advise you throughout the entire process and answer all of your questions. Some of the benefits of hiring an estate planning lawyer in Bloomington IL include:

- Every estate plan is unique: Each estate plan is different because not everyone has the same needs and goals. An estate plan that works for your neighbor might not necessarily work for you. An estate planning lawyer Bloomington IL families trust can help you create a customized plan that focuses on your unique goals.

- Errors are costly: If you don’t have experience with estate planning, it’s easy to make mistakes. The smallest errors can cost extra money and lead to unnecessary hassles. An estate planning lawyer can help you create an error-free plan in a timely fashion.

- A will might not fit your needs: When it’s time for estate planning, many people assume that drafting a will is the best option for them. While a will is one of the most common estate planning options, it might not be right for you. A revocable living trusts might fit your needs better. A skilled estate planning lawyer may go over all your options with you and help you choose a plan that suits your needs.

- Your estate plan may need updates: It’s likely that your estate plan will require updates in the future. For example, you may choose to add or remove a person from your will. An estate planning lawyer Bloomington IL relies on may assist you with making these necessary updates in an efficient manner.

What should I expect during an initial consultation with an estate planning lawyer?

If you have scheduled a consultation with a Bloomington estate planning lawyer, it’s important to be prepared. Bring all the documents related to your assets and liabilities and be ready to answer several tough questions. For example, a lawyer may ask you who you want to raise your children if you die and if you have any heirs with special needs.

Don’t be afraid to come with a list of questions you want to ask your lawyer. Asking the right questions may help you determine if the lawyer is the right fit or not. Here are a few questions you may want to ask an estate planning lawyer Bloomington IL offers:

- What is your experience dealing with trusts and estates?

- How long will it take you to complete my estate plan?

- If an unexpected issue arises with my estate, will you be able to help me right away?

- Is your primary focus on estate planning?

- Will you send me the estate plan to review?

FAQ: What happens if I die without a will?

Passing away without a written will, also known as intestate, allows the state’s laws of descent and distribution to determine who receives your property by default. Typically, the distribution of your assets is split among your spouse and children. Even if you wish to have your property split among your spouse and children, an intestate, does not provide specifics of how your assets should be distributed. A Bloomington estate planning lawyer may help you outline specific wishes that you want carried out after you have passed.

FAQ: How do I provide for my children?

One of the primary goals for establishing a will is to provide and protect for the future of your loved ones. In the case of an emergency, you should include the names of a guardian for any children that are under the age of 18. Naming a guardian for your children is specified in a will and an estate planning lawyer Bloomington IL provides, may be able to help provide guidance when choosing a guardian.

If you’re starting your estate plan and you should find the right estate planning lawyer from Bloomington, Illinois like the team at Pioletti Pioletti & Nichols to help answer any questions you might have.

Client Review

“Mike did an excellent job helping me work through an expungement hearing. Very professional, well prepared, and treated me like family. Would highly recommend.”

D C