Bankruptcy Lawyer Champaign IL

Bankruptcy Lawyer in Champaign Illinois

A bankruptcy lawyer Champaign, IL offers knows that it can happen to anyone living in Illinois or other states throughout the country, whether through job loss, medical condition, or some other cause, where a person’s debt becomes so overwhelming that there just seems no way out. For many of these people, filing for bankruptcy is the best and smartest choice. But filing for bankruptcy is both a serious and legal option and one that shouldn’t be rushed into. If you are considering filing for bankruptcy, it is recommended you speak to a bankruptcy lawyer Champaign, IL residents trust from Pioletti Pioletti & Nichols.

Table Of Contents

- Common Myths About Bankruptcy

- Common Myths About Bankruptcy Infographic

- Getting Help When You Need It Most

- What Debt Collection Attorneys Do

- What To Expect From Your Lawyer

The following are some frequently asked questions that our legal team often hears from our clients. For more detailed assistance for your situation, contact our office to schedule a free and confidential consultation.

When Should a Person File for Bankruptcy?

There is no right or wrong answer to this question since filing is such a personal decision and every situation is different. Filing for bankruptcy should really be the last resort after a person has examined all their other options, such as consolidating debt and budgeting monthly payments. If the amount of debt a person has is so much that there really are no other options to relieve the burden, then bankruptcy may be the right choice.

Which Type of Bankruptcy Should a Person File?

Just as when to file for bankruptcy depends on an individual’s situation, the type of bankruptcy also falls in this category. There are two types of personal bankruptcy an individual can file, Chapter 7 and Chapter 13. Chapter 7 bankruptcy will discharge most, if not all, of a person’s debt. This allows the person to begin anew with a clean financial slate. Chapter 13 bankruptcy gives the filer a repayment plan to pay off their debts instead of discharging them. If you are unsure of which type of bankruptcy is best for you, a Champaign, Illinois bankruptcy lawyer can provide you with that legal advice.

Will Bankruptcy Affect a Person’s Credit Score?

While filing for bankruptcy will have some sort of impact on a filer’s credit score, the reality is that a person who has reached the point where they need to file because their debt and financial situation is overwhelming is likely already experiencing a negative impact on that credit score because of late and missed debt payments. A person with a higher credit score who files for bankruptcy will drop more points than a person who has a lower score.

Contact Pioletti Pioletti & Nichols for Assistance

If you are considering filing for bankruptcy, don’t attempt to go through this process alone. Filing for bankruptcy can be a complex process and one mistake or missing document can result in the courts not accepting the filing and forcing you to start the process all over again, wasting valuable time. Call our office today to schedule a free and confidential consultation with a Champaign, IL bankruptcy lawyer and find out how we can help you achieve a new financial start.

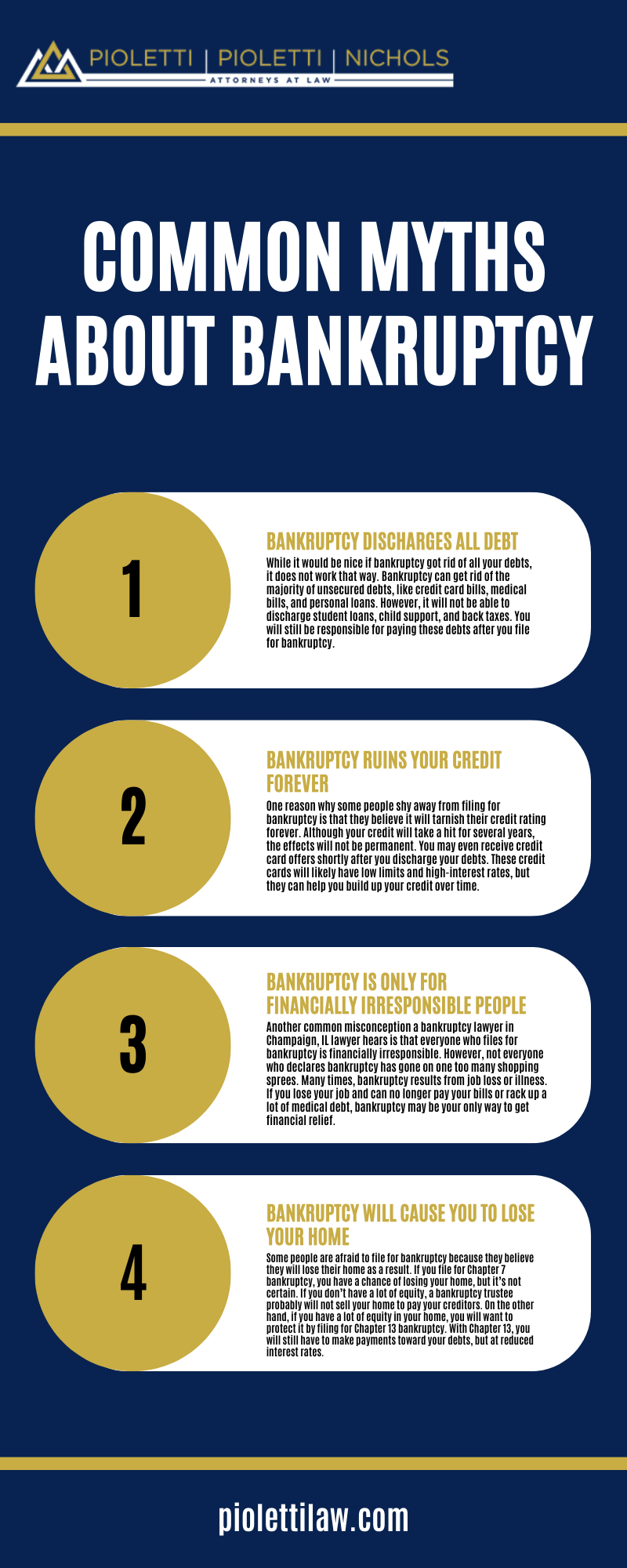

Common Myths About Bankruptcy

Bankruptcy can help you get rid of most of your unsecured debts, so you can have a financial fresh start. However, there are many myths about the process that keep some people from filing for bankruptcy. Here are some common misconceptions about bankruptcy a bankruptcy lawyer in Champaign, IL hears:

Bankruptcy Discharges All Debt

While it would be nice if bankruptcy got rid of all your debts, it does not work that way. Bankruptcy can get rid of the majority of unsecured debts, like credit card bills, medical bills, and personal loans. However, it will not be able to discharge student loans, child support, and back taxes. You will still be responsible for paying these debts after you file for bankruptcy.

Bankruptcy Ruins Your Credit Forever

One reason why some people shy away from filing for bankruptcy is that they believe it will tarnish their credit rating forever. Although your credit will take a hit for several years, the effects will not be permanent. You may even receive credit card offers shortly after you discharge your debts. These credit cards will likely have low limits and high-interest rates, but they can help you build up your credit over time.

Bankruptcy Is Only for Financially Irresponsible People

Another common misconception a bankruptcy lawyer in Champaign, IL lawyer hears is that everyone who files for bankruptcy is financially irresponsible. However, not everyone who declares bankruptcy has gone on one too many shopping sprees. Many times, bankruptcy results from job loss or illness. If you lose your job and can no longer pay your bills or rack up a lot of medical debt, bankruptcy may be your only way to get financial relief.

Bankruptcy Will Cause You to Lose Your Home

Some people are afraid to file for bankruptcy because they believe they will lose their home as a result. If you file for Chapter 7 bankruptcy, you have a chance of losing your home, but it’s not certain. If you don’t have a lot of equity, a bankruptcy trustee probably will not sell your home to pay your creditors. On the other hand, if you have a lot of equity in your home, you will want to protect it by filing for Chapter 13 bankruptcy. With Chapter 13, you will still have to make payments toward your debts, but at reduced interest rates.

Common Myths About Bankruptcy Infographic

Getting Help When You Need It Most

Filing for bankruptcy can be complicated and it is not always so clear-cut as to whether filing is the right thing to do or not. You may wish you had a quick list to look over to help you determine if filing for bankruptcy is the best option.

Reasons Why Filing For Bankruptcy Could Help You

- You will be able to keep exempt property

- It can help you when your utilities are about to be shut off

- If you do not have a driver’s license because it was taken for not paying a debt, you can get it back

- You no longer have to worry about repossessions or foreclosures unless a court specifically allows them to proceed

- Chapter 13 bankruptcy can allow you to keep certain property that is especially important to you

Reasons Why Filing For Bankruptcy May Not Help You

- You may have other, better options for protecting your property that do not include filing for bankruptcy

- You will have a difficult time rebuilding your credit and getting loans after filing for bankruptcy

- You may not be able to keep all of your property

- Bankruptcy will stay on your credit for many years

- Not all debt will be wiped away from bankruptcy, including debts like student loans, child support, and alimony

It is imperative that you speak with your trusted Champaign, Illinois bankruptcy lawyer before filing for bankruptcy process so that you can determine if this is the best solution for you and your family when it comes to finding financial freedom.

Are there any filing fees involved with bankruptcy?

Many people are surprised to find out that there are filing fees when it comes to bankruptcy. In some instances, you may have a hard time paying the filing fee. When that is the case, you may be able to petition the court to make payment installations when filing for Chapter 13 bankruptcy. Similarly (and under very certain circumstances), you may be able to ask the court to waive the filing fee when you are applying for Chapter 7 bankruptcy. If you are concerned about paying the filing fee for bankruptcy, make this known to your attorney as soon as you begin the bankruptcy process.

Can you file for bankruptcy with your spouse?

You and your spouse can file for bankruptcy together but that does not necessarily mean that it is the best idea. Speak with your attorney about whether it would be beneficial for you to file separately or jointly. This will depend on different factors, like whether one or both spouses are liable for the debts you are hoping to get rid of.

Hiring a Bankruptcy Lawyer Isn’t Necessary

Many people who want to file for bankruptcy are struggling financially and don’t know if they can afford to hire a bankruptcy lawyer in Champaign, IL. However, filing for bankruptcy without a lawyer is incredibly risky. It is a complex process and making simple mistakes on your filing can get your case thrown out. That is why it is wise to invest in an experienced lawyer. Call our trusted Champaign, Illinois bankruptcy lawyer now!

What Debt Collection Attorneys Do

One of the many things a bankruptcy lawyer in Champaign, IL can help you with is debt collection. When you’re faced with a lawsuit because of debt you incurred, you might be nervous or panicked. Fortunately, there are professionals who handle these types of situations every day. A debt collection attorney might be the exact person you need to help you through your case whether you’re the creditor or the debtor. What can a debt collection attorney do?

Evaluating The Debt

Your debt collections lawyer might take a good long look at the debt and the debtor. Many lawyers look at the legal collectability to determine whether the debtor has a strong case. The statute of limitations will typically be given a hard look, as will documents the debtor plans to use as evidence. A lawyer might look into the creditor to see how often they file these types of lawsuits, as well as how often they are successful.

Filing A Lawsuit

Debt collections and bankruptcy lawyers can work on both sides of the case. If you are a creditor and plan to file a lawsuit against someone who owes you money, a debt collections lawyer can help you make your case and file the lawsuit. If you are the debtor and you feel a lawsuit has been wrongly filed against you, a bankruptcy lawyer in Champaign, Illinois might be able to help you make a counterclaim.

Preparing The Case

Regardless of the side of the case you’re on, it could be beneficial to have a bankruptcy lawyer help you prepare and make the case. If you’re the debtor, your bankruptcy lawyer can prepare a case that includes your financial situation overall. If you are the creditor, your bankruptcy lawyer might prepare a case that includes documents the debtor signed saying the debt would be paid back at a particular time.

Negotiating For Clients

Debt collections and bankruptcy lawyers are typically great negotiators for both sides of the situation. Repayment plans that benefit both parties can be negotiated. If you try to do this without the assistance of a bankruptcy lawyer, you might not understand what you are entitled to, and the negotiating might not be fair for your side. Talk to our firm’s experienced bankruptcy lawyers to discuss the best strategy for your needs.

Pursuing The Debt

As a creditor, you deserve the money you are owed. If all else fails, your bankruptcy lawyer can aggressively pursue the debt, even if that means filing judgment liens or having wages garnished. At Pioletti, Pioletti & Nichols, our bankruptcy legal team is determined to help you find hope for a better future.

Getting Your Lawyer Involved

You can see how complicated the debt collections process can be. Whether you’re a debtor or a creditor, you could benefit from hiring a bankruptcy lawyer or debt collections attorney. Contact a bankruptcy lawyer in Champaign, IL from Pioletti, Pioletti & Nichols today to get him or her involved in the case.

What to Expect From Your Lawyer

Hiring a bankruptcy lawyer in Champaign, IL is a task that comes with various anxieties. What if you hire the wrong one? How do you know you have a good lawyer to start with? If you’ve never worked with a lawyer before this can be a task you want to avoid, but as stated above not hiring a lawyer can make folding for bankruptcy even harder. Pioletti, Pioletti & Nichols has the skill and expertise to help you with your task as they follow the expectations below.

Expect Competence

Not all cases are going to be complicated but they aren’t all walks in the park either. Your lawyer should have the skill level to handle your case with ease, no matter what is thrown at them. Knowing they know the ins and outs of the law will make your life easier, as you know your case will be in good hands.

In general, the difficulty of your case will depend on a few factors. The facts of the case, which file you fall under (Chapter 7 or Chapter 13), if you own a small business, if the bankruptcy trustee will sell any of your property, and the involvement of bankruptcy litigation will all make your case more or less difficult.

One of the best ways to find out if your lawyer knows what they are doing is ask if they have handled similar clients in similar situations in the past.

Expect Sound Legal Advice

In general, the retainer agreement you sign will outline the services your lawyer will provide. Their job is to also give you competent advice through the whole bankruptcy process. That is one of their main jobs to help you through the case.

When you see a lawyer from Pioletti, Pioletti & Nichols, they will give you the sound advice on if bankruptcy is in your best interest. You can expect an honest answer to the question as filing for bankruptcy is a difficult and life-changing task for most people. No competent lawyer will force you into a bankruptcy filing if it isn’t the right choice for you.

You’ll also want a lawyer that can answer your questions in a timely fashion. You don’t want to be waiting days on end for an answer or get ignored completely.

Expect Your Lawyer to File and Prepare Your Paperwork

Filing for bankruptcy requires many lengthy forms. In most cases, a bankruptcy lawyer has software that prepares and files the paperwork with the court. It makes it easier and nothing gets lost on the way back and forth.

What you will need to do is give your lawyer your financial information. This would include your income, expenses, assets, and debt information. From there your lawyer will prepare the official forms and then go over the completed paperwork with you.

Not having this paperwork done promptly can result in delays in the process or even dismissal of your case. This is why your lawyer will have everything ready before then, so you don’t have to worry about going to hearings and missing something.

When it comes to finding a bankruptcy lawyer in Champaign, Illinois you can trust that your case will be in good hands. Pioletti, Pioletti & Nichols has the experience to take on your bankruptcy case as you know they pay attention to detail.

Why Should I Hire a Bankruptcy Lawyer?

If you have decided to file for bankruptcy, you’re likely having trouble with your finances. As such, you might wonder if it’s worth the money to hire a bankruptcy lawyer. You are already in so much debt that you can’t imagine spending more money. However, you must remember that bankruptcy is a complicated process with many rules and regulations. If you unknowingly make an error, it could hurt your case. That is why it pays to have a skilled lawyer on your side.

A bankruptcy lawyer can be a great asset to have. For one thing, he or she can help you decide between Chapter 7 and Chapter 13 bankruptcy. If you, for example, still have a job and want to keep your home, your lawyer may advise you to file for Chapter 13 bankruptcy. Your lawyer can also help you fill out the mountains of bankruptcy paperwork. These documents can include complicated terminology that the average person doesn’t understand. If you make errors, it could get your case thrown out.

How Soon Should I Speak to a Bankruptcy Lawyer?

Many people wait too long to speak to a bankruptcy lawyer about their situation. They may hope that their situation may improve and they won’t need the services anymore. This is a big mistake. It is in your best interest to consult an experienced bankruptcy lawyer in Champaign, IL as soon as possible. He or she can assess your situation and determine if bankruptcy is the choice for you.

What Questions Should I Ask a Bankruptcy Lawyer?

During your first consultation, your bankruptcy lawyer shouldn’t be the only person asking questions. To determine if a lawyer is the right person to represent you, it is important to ask the right questions. For example, you might want to ask about the positives and negatives about filing for bankruptcy and what percentage of his or her firm is dedicated to bankruptcy cases.

What debts can and can’t be discharged in bankruptcy?

Most unsecured debts, like medical bills, payday loans and credit card debt, can be discharged in bankruptcy. However, if you have secured debts, like student loans, child support or tax debts, you won’t be able to discharge them in bankruptcy.

What are the two types of bankruptcy?

People in debt have the option of filing Chapter 7 or Chapter 13 bankruptcy. Chapter 7 bankruptcy discharges your unsecured debts, but you may have to sell some of your assets in return. With Chapter 13 bankruptcy, you must pay back some or all of your debts through a repayment plan, but you can keep all your property.

A bankruptcy lawyer can help you decide on the type of bankruptcy to file.

How long does bankruptcy take to complete?

Chapter 7 bankruptcy typically takes between four and six months to complete. Chapter 13 bankruptcy, on the other hand, can take three to five years to involve.

Will filing for bankruptcy affect my credit?

A common concern people have about filing for bankruptcy is the impact it will have on their credit rating. It is true that your credit score will go down after you file for bankruptcy. However, you can start rebuilding your credit right away. A bankruptcy lawyer in Champaign, IL may advise you to apply for a secured credit first to slowly increase your credit score.

Will filing for bankruptcy stop creditors from contacting me?

Yes. Once you file for bankruptcy, the court will issue an automatic stay, which will prohibit creditors from calling you. If your creditors still attempt to contact you by phone or mail, you should inform your lawyer right away.

Can I create new debt before filing for bankruptcy?

No. One of the biggest mistakes people make before bankruptcy is making major purchases on their credit cards. If you charge a vacation or other big purchase on a credit card, it will not be discharged during your bankruptcy.

If you want to file for bankruptcy, you should schedule a consultation with a bankruptcy lawyer in Champaign, IL today.