Chapter 13 Bankruptcy Lawyer Kankakee, IL

What is bankruptcy?

Bankruptcy is a federal court process that allows individuals to manage their debts while protecting themselves from the harassment of creditors. Once you file for bankruptcy, all the procedures put in place to collect your debts will be temporarily stopped, including lawsuits. This “automatic stay” gives you and an experienced Kankakee, Illinois Chapter 13 bankruptcy lawyer an opportunity to navigate the ins and outs of your case without the added pressures of creditor harassment affecting the process.

Are there different kinds of bankruptcy?

Yes, if you are filing as a consumer — as opposed to a business owner — you generally have two options for filing, Chapter 7 or 13.

Chapter 7 is commonly referred to as “liquidation bankruptcy.” This option is reserved for persons whose income is not substantial enough to pay off their debts in a timely manner. If you qualify for this type of bankruptcy, your eligible debts could be erased in as few as 90 days.

If you are not eligible to file for bankruptcy under Chapter 7, an experienced Kankakee, IL Chapter 13 bankruptcy lawyer from Pioletti Pioletti & Nichols can help you to file under Chapter 13. Chapter 13 bankruptcy allows you to create a repayment plan that makes your debts easier to manage. If you pay back your debts according to the terms of a 3-5 year repayment plan, your eligible debts will be erased once that term expires.

Signs That Bankruptcy May Be In Your Best Interest

Are you struggling with so much debt that you aren’t sure how to dig yourself out? A Chapter 13 bankruptcy lawyer Kankakee, IL can understand the pressure and stress that you may be going through as a result of accumulating a substantial amount of debt without earning enough funds to pay them off slowly overtime. Here at Pioletti Pioletti & Nichols, we don’t take the choice to file for bankruptcy lightly. We always ensure to evaluate each client’s unique circumstances and then advise whether it will be in their best interest. If you aren’t sure whether it’s time to book a consultation, here are just a few signs that it’s probably the right next step:

You May Lose Your Home

Receiving a notice that your home is about to be foreclosed on can be enough to surge someone into a full blown panic attack. If you recently got information that you are facing foreclosure, please know that you are not alone. There are many homeowners who purchased a home with only the best of intentions, to ultimately realize that they can’t keep up with payments after all. As a Chapter 13 bankruptcy lawyer Kankakee IL can explain during a consultation, bankruptcy may enable you to keep your home while reorganizing your financial situation in the long-term. Call Pioletti Pioletti & Nichols today for a free consultation.

You Are Drowning in More Debt Each Month

Every month we have bills to pay, such as rent, utilities, health insurance, cell phone plans, groceries, college tuition, child care, and so much more. If you are getting into further debt as each month passes and aren’t able to pay at least the minimum payments, then we advise speaking with a Chapter 13 bankruptcy lawyer Kankakee IL as soon as possible. Perhaps what is needed is a reassessment of spending compared to how much you earn, or we may conclude that bankruptcy may just be in the cards for your best interest.

The Court Has Begun Garnishing Your Wages

You may have recently noticed that your paychecks are less than they used to be, and that could be due to wage garnishment. What happens is a debt collector may request to the court that you pay a portion of your outstanding debts on a consistent basis through each paycheck. Your Kankakee IL Chapter 13 bankruptcy lawyer from Pioletti Pioletti & Nichols may suggest not trying to negotiate with your employer on this, since he or she is mandated by the court to abide by their request. If filing for bankruptcy becomes the right choice, then the wage garnishments would halt due to an automatic stay being enforced.

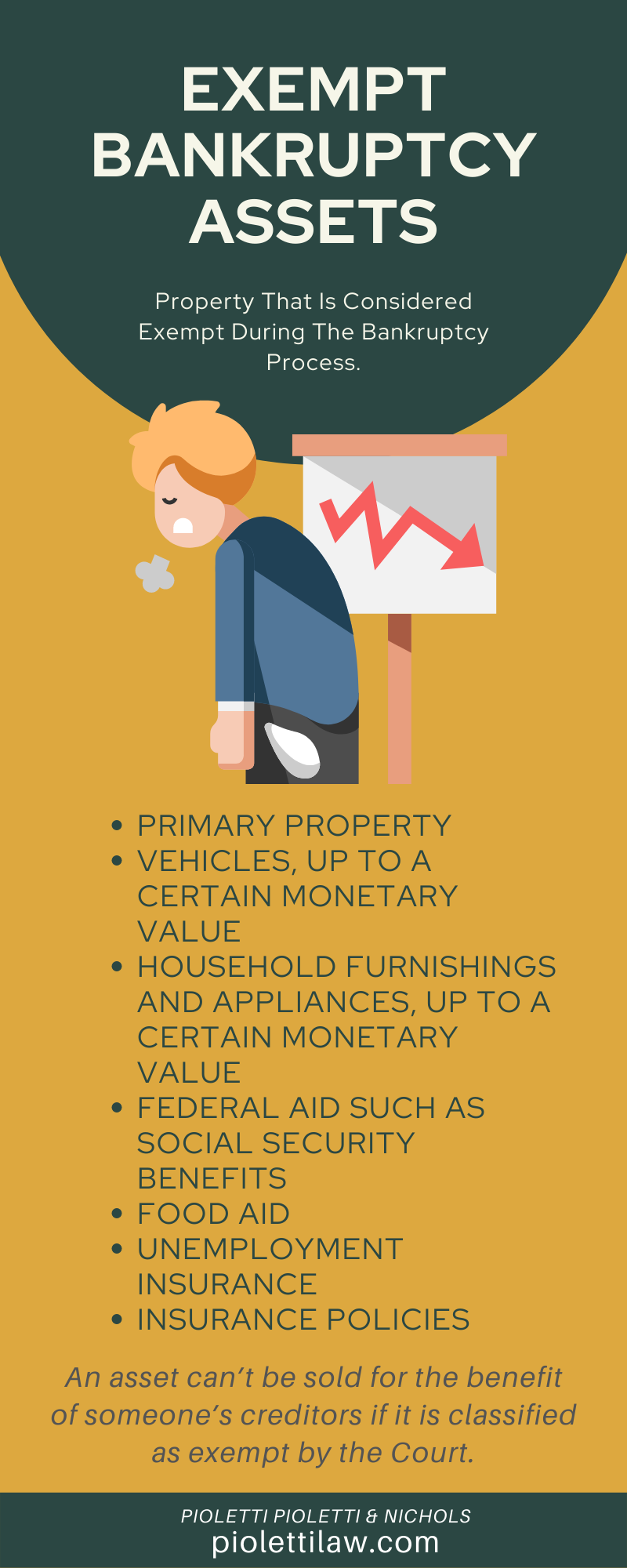

What are non-exempt assets?

Each state has a different definition of what it means to have exempt assets. An asset can’t be sold for the benefit of someone’s creditors if it is classified as exempt by the Court. An experienced Kankakee, IL Chapter 13 bankruptcy lawyer can help to ensure that as much of your property as possible is considered exempt during the bankruptcy process. Generally speaking, a person’s exempt assets include:

- Primary property

- Vehicles, up to a certain monetary value

- Household furnishings and appliances, up to a certain monetary value

- Federal aid such as social security benefits, food aid, or unemployment insurance.

- Insurance policies

What will happen to my home during this process?

Your home will most likely be protected in the case of filing for bankruptcy. In fact, if you are falling behind on your mortgage, then filing Chapter 13 can serve as an option to help you restructure your payments in a more feasible manner.

You do not have to face the daunting road of bankruptcy alone. When you work with an experienced Kankakee, IL Chapter 13 bankruptcy lawyer, you’ll benefit from the assistance of a legal professional dedicated to advocating for your interests.

Chapter 13 Bankruptcy Lawyer Kankakee, IL

If you are considering Chapter 13 bankruptcy, speak with a Chapter 13 bankruptcy lawyer in Kankakee, IL from Pioletti Pioletti & Nichols. Having to consider bankruptcy is often a difficult and unfortunate decision, but may be necessary if loan and credit card payments have become too much for your budget to handle. Going through the process allows you to reduce serious debts, improve your overall financial situation, and move on. There are two types of bankruptcy to consider as an individual and it’s important to understand the differences between the two so you can decide which is best for your unique situation. This is where a Kankakee, IL Chapter 13 bankruptcy lawyer can help you.

Chapter 13 BankruptcyChapter 13 bankruptcy is a reorganization of your finances. Your property is not required to be liquidated, so long as you stick with the repayment plan that is mandated to you by a court. In this type of bankruptcy, the court determines how much of your debt you will be responsible for paying back, often over the course of three to five years. Once you’ve completed this portion, the rest of any unsecured debts, like medical bills or credit cards, will be “discharged,” meaning you are not required to pay it back.

To file for Chapter 13, your debts cannot exceed a certain monetary limit:

- Unsecured debts (eg. medical and credit cards): $419,275 (as of 2019)

- Secured debts (eg. mortgages and car loans): $1,257,850

A Chapter 13 bankruptcy lawyer in Kankakee, IL knows the benefits of this type of bankruptcy, other than keeping your property, is that it gives you the opportunity to catch up on your mortgage and car loan payments, helping you avoid foreclosure or repossession. The court may also decide to reduce the balance owed on some of these debts if needed.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy, or liquidation bankruptcy, is often used by those who have a limited income and are unable to pay back some or all of their debts. This option is generally chosen by individuals who do not own a home and whose income is below the median level for your state. If your income is above this level, you will be asked to pass a “means test” which determines if you’re able to pay back some of your debts. If you are found to be able to pay back some of your debts, you will be required to file Chapter 13 instead.

The benefit of filing for Chapter 7 is that it allows you to discharge most debts quickly, often within three to five months. The unfortunate side of this type of bankruptcy is your trustee will be required to sell all of your nonexempt property to pay off as much of your debt as possible. This does not make up for any missed mortgage payments and will not stop a foreclosure or repossession.

Consult with a Chapter 13 Bankruptcy Lawyer in Kankakee, Illinois!

If you are considering filing for bankruptcy, please do not be embarrassed. Many clients come to us feeling devastated that their financial situation has become so dire that bankruptcy is in their best interest. But, the option of filing for bankruptcy is there for a reason, so people can eventually work their way out of a very serious financial setback.

Filing for bankruptcy can be a complex process. It may not be clear which type you are eligible for, and which would benefit you the most while doing the least amount of damage. Consult with a Chapter 13 bankruptcy lawyer Kankakee, Illinois residents rely on from Pioletti Pioletti & Nichols to ensure your rights are protected, that the whole process goes smoothly, and that the court makes decisions in your best interest.

Chapter 13 Bankruptcy Lawyer Kankakee IL

A Chapter 13 bankruptcy lawyer is an experienced attorney who has been approved by the United States Trustee Program. This program oversees all bankruptcy cases to ensure that they are handled correctly.

A Chapter 13 bankruptcy lawyer can help you decide whether filing for bankruptcy is right for you and your family. If you do decide to file for bankruptcy, he or she will represent your best interests in court.

Here are some FAQs about a Chapter 13 bankruptcy lawyer:

What is a Chapter 13 bankruptcy?

A Chapter 13 bankruptcy is also known as a wage-earner’s plan. It allows individuals who earn too much money to file a Chapter 7 case, but who still have debts they can’t afford to repay in one lump sum, to make monthly payments to a trustee over three to five years.

How is it different from Chapter 7?

Chapter 13 works differently than Chapter 7. With Chapter 13, you repay some of your debt through monthly installments paid directly to the court. You get to keep your property and pay off only part of your debt. In a Chapter 7 case, all debts must be completely discharged or canceled by the court so that you are no longer responsible for paying them.

How much will it cost me to file Chapter 13 bankruptcy?

There are no upfront costs to file for bankruptcy. The court charges filing fees and trustee fees, but these fees are paid from your assets when you receive them after the case is closed. In addition, there is a fee for a Chapter 13 bankruptcy lawyer if you choose to hire one to represent you in court.

Can I still file for Chapter 7 bankruptcy?

Yes! It’s possible to have both Chapter 7 and 13 bankruptcies on your record at the same time (called “concurrent”). If you want to do this, speak with a Chapter 13 bankruptcy lawyer from Pioletti Pioletti & Nichols first so they can discuss how this might affect your case as well as other factors such as whether or not these two types of cases can be combined into one petition instead of two separate filings or whether they’ll need two separate hearings before two different judges or trustees in two different courts.

How long does it take to file for Chapter 13?

It will take about six months from start to finish, but the actual time depends on how complex your case is. If you have any unusual circumstances or if you’re not able to file right away, it could take longer.

Can I keep my house in Chapter 13?

Yes, if you can afford to make the payments required by your plan and there are no other liens on the property like a mortgage lien or a second mortgage lien (also known as an “equity loan”) — but only if the lender agrees to let you keep making payments even though they won’t receive payment during the Chapter 13 plan period (three to five years). Sometimes lenders require that you sell the property instead of keeping it during the Chapter 13 repayment plan period.

A good Chapter 13 bankruptcy lawyer from Pioletti Pioletti & Nichols will be able to guide you through each step of the process, from preparing documents to filing them with the court, collecting information from creditors and debtors, negotiating repayment plans with creditors, and finalizing the case once all debts are paid or discharged.

Client Review

“Michael was a huge help to me with my issues. I feel as if he genuinely cared for me as a client.”

Brandon Quickel