Springfield, IL Bankruptcy Lawyer

Committed To Helping You Through Financial Distress

After you file bankruptcy with the assistance of a bankruptcy lawyer Springfield IL residents trust, your credit rating will take a hit. However, understand that this effect is only temporary. You can take steps to repair your credit.

Table of Contents

- Springfield IL Bankruptcy Infographic

- 3 Major Consequences of Filing for Bankruptcy

- Bankruptcy Myths

- Common Mistakes to Avoid Before Filing for Bankruptcy

- Bankruptcy Lawyer Springfield IL

- Springfield Bankruptcy Lawyer Statistics

- Pioletti Pioletti & Nichols Springfield Bankruptcy Lawyer

Continue Paying Your Non-Bankruptcy Accounts

While bankruptcy discharges most of your debt, it might not get rid of all of it. Find out which accounts weren’t closed, such as your student loans, and continue paying them. Try to make more than the minimum payment on these accounts so that you can lower your debt-to-income ratio faster.

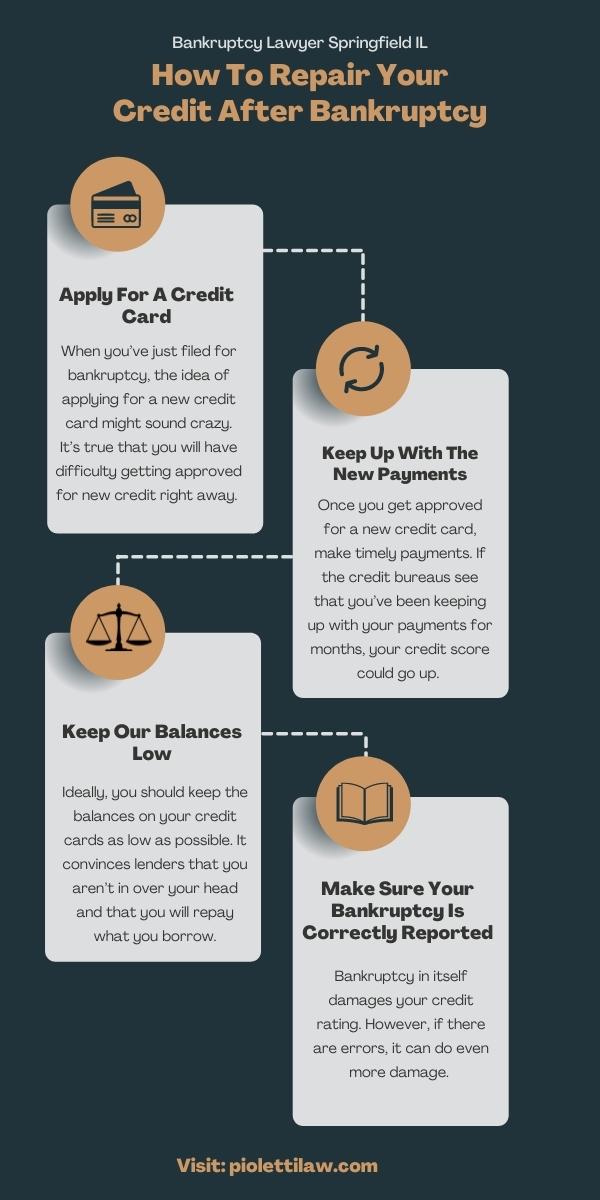

Apply for a Credit Card

When you’ve just filed for bankruptcy, the idea of applying for a new credit card might sound crazy. It’s true that you will have difficulty getting approved for new credit right away. You may even have to pay more in interest and fees. The best way to get approved right now is to apply for a secured credit card. These credit cards require a cash deposit. If you make timely payments on this card, you can improve your credit over time and will have a higher chance of getting approved for unsecured credit cards.

Keep Up Payments With New Credit Cards

Once you get approved for a new credit card, make timely payments. If the credit bureaus see that you’ve been keeping up with your payments for months, your credit score could go up. If you have trouble remembering to make your payments, a bankruptcy lawyer in Springfield, IL may recommend enrolling autopay or setting reminders on your smartphone to make your payments.

Don’t Job Hop

Although changing jobs frequently won’t impact your score directly, it can make lenders think twice about giving you a loan. They might not think you have reliable income to repay the loan. That’s why you should avoid job hopping as much as possible.

Keep our Balances Low

Ideally, you should keep the balances on your credit cards as low as possible. It convinces lenders that you aren’t in over your head and that you will repay what you borrow. Try to keep your credit utilization ratio less than 30 percent.

Ensure Your Bankruptcy is Correctly Reported

Bankruptcy in itself damages your credit rating. However, if there are errors, it can do even more damage. For instance, if a debt shows up as active instead of discharged, it could hurt your credit. That’s why a bankruptcy lawyer in Springfield, IL suggests obtaining a free credit report and checking it for inaccuracies. If you catch mistakes, you should dispute it as soon as possible. Call Pioletti Pioletti & Nichols today.

Springfield Bankruptcy Infographic

3 Major Consequences of Filing for Bankruptcy

Filing for bankruptcy is not something to be taken lightly. At some point, serious debt may become unmanageable, and with the help of a bankruptcy lawyer in Springfield IL, you can file to remove certain types of debt. However, this is a serious financial decision, so make sure you consider all the potential aftereffects and even seek counsel from a firm like Pioletti Pioletti & Nichols.

Loss of Property

You can file for Chapter 7 or Chapter 13 bankruptcy. Both have different levels of debts that you can eliminate and varying degrees of consequences, but regardless of the type of bankruptcy you file for, filing can result in the loss of some of your assets. For example, you may be forced to give up your car or house, which could be liquidated to pay off your lenders. This also extends to personal property, like jewelry or antiques. If you have personal belongings that are important to you, or if you don’t have somewhere to go should your house be taken from you, make sure you consider the risks.

Difficulty Getting Financing

Your credit report is how lenders determine what level of risk you are, and seeing that you have previously filed for bankruptcy labels you as “high risk.” This means that creditors will either offer you high interest rates or may even flat out deny you. A bankruptcy can stay on your report for up to 10 years in some cases. Whether you need a credit card or a mortgage, securing financing can be made extremely difficult for a decade. You can, however, try to get approved for secured credit cards with a cash deposit. A bankruptcy lawyer in Springfield IL from Pioletti Pioletti & Nichols will tell you that having this credit source is an essential step to repairing your credit over time. So long as you use it frequently, pay it off regularly and early, and keep your credit utilization under 30%, you’ll be in good shape.

Lingering Debt

Bankruptcy doesn’t necessarily get rid of all debt. Some debt, such as student loans, government fines, and court-ordered payments such as alimony or child support cannot be forgiven. Additionally, anyone who has co-signed on debts with you will still be held responsible for their share. Ultimately, this could hurt your personal relationships, so make sure they are aware of your decisions prior to filing. There could also be errors on your credit report if the debt is still considered active. Your best bet is to obtain a credit report and consult a bankruptcy lawyer in Springfield IL to figure out what debts can be forgiven and what to do moving forward.

Bankruptcy Myths

People Who File for Bankruptcy Are Financially Irresponsible

This actually is not the case. There are many factors that can lead to someone filing for bankruptcy. Things such as job loss, divorce, or even the high cost of medical care can drive just about anyone into bankruptcy. The recent pandemic has even started to trigger a wave of businesses and households to file for bankruptcy. Even the most well-intentioned people can fall into bankruptcy. This doesn’t mean that they are financially responsible or unable to stay away from credit cards. Overwhelming debt can happen to just about anyone.

Bankruptcy Discharges All Past Debts

Many people file for bankruptcy hoping for a fresh start. However, there are several types of debts that are not discharged in bankruptcy. If you have domestic support obligations such as alimony or child support those can’t be removed under any circumstance. Student loans are also typically not discharged in bankruptcy unless you can prove a hardship. Tax debts are sometimes reduced or discharged but it truly depends on the circumstances. This is when talking to a lawyer is the best way to know what can and cannot be discharged because of bankruptcy.

If You Spend Money Recklessly Before Bankruptcy You Won’t Have to Pay Back That Money

You could actually cost yourself your bankruptcy case if you do this. Maxing out your credit cards in hopes the balances will be forgiven through bankruptcy is called presumptive fraud. In order to avoid this, you should not spend $725 or more on luxury goods or services within 90 days of filing for bankruptcy. Is often your best bet to stop using credit cards altogether if possible. There are circumstances that can be overlooked such as paying for essentials like food, shelter, and gas.

Bankruptcy Ruins Your Credit Forever

While the bankruptcy can be on your credit report for up to 10 years it does diminish over time. This means that you can start rebuilding your credit pretty much right after you file for bankruptcy. In order to keep improving your credit score, you need to make your payments on time and make sure not to spend more than you have. The idea behind bankruptcy is to help you get back on your feet financially and not to doom you forever.

If you or a loved one are thinking about filing for bankruptcy then reach out to a bankruptcy lawyer in Springfield, IL like the team at Pioletti Pioletti & Nichols for more information.

Common Mistakes to Avoid Before Filing for Bankruptcy

Declaring bankruptcy can give you a financial fresh start and take a huge weight off your shoulders. However, if you make the wrong moves before filing, you could jeopardize your bankruptcy case. Here are some common mistakes to avoid before filing for bankruptcy.

- Repaying family members. If you have borrowed money from family members during tough financial times, you may feel obligated to pay them back right away. However, if you do this before filing for bankruptcy, it can do more harm than good. The bankruptcy trustee may decide to sue your family members for the money and distribute the money to your creditors.

- Taking money out of your retirement account. Sometimes people who are deep in debt withdraw money from their retirement account to stay afloat. This is a big mistake. Retirement accounts are typically protected from creditors’ claims.However, if you withdraw money from the account, creditors can go after it then.

- Not telling your lawyer the truth. Your bankruptcy lawyer in Springfield, IL is there to help you. However your lawyer can’t help you to the fullest if he or she does not know the whole truth. You should never hide anything from your lawyer, no matter how embarrassed you may feel.

- Accumulating more debt. One of the last things you want to do before filing for bankruptcy is getting deeper into debt. If you use your credit card to charge frivolous items within the 90 days before you file for bankruptcy, the charges won’t be discharged.

- Transferring assets. In Chapter 7 bankruptcy, you have the opportunity to discharge unsecured debt, like medical bills and credit card bills. The bankruptcy trustee may then be allowed to sell some of your property. Some people who declare bankruptcy want to keep their assets, so they may transfer them into a family member’s name. This is another mistake you should avoid making. If the court finds out, your case may get thrown out.

- Leaving assets out of your bankruptcy paperwork. When you fill out bankruptcy paperwork, you’re required to list all of your assets. However, some people may leave certain assets out to keep them from getting sold. This tactic will rarely work. The court will likely find out and dismiss your bankruptcy petition because you were dishonest.

At Pioletti Pioletti & Nichols, a bankruptcy lawyer Springfield IL residents depend on can give you advice as to whether filing for bankruptcy is in your best interest. When people hit a severe financial hardship, they may wonder whether filing for bankruptcy is their last and only option. The year 2020 has been particularly tough for most, and has led people to thinking about bankruptcy as a potential solution for their financial struggles. If you are considering filing for bankruptcy, we strongly urge you to speak with a reputable lawyer, such as one from our law firm, as soon as possible. The entire process can be complicated and confusing, so having a lawyer to work alongside you can esure that everything goes smoothly. When clients meet with us, they often have the same common questions, which have been briefly answered below. For more information, contact Pioletti Pioletti and Nichols today.

Bankruptcy Lawyer Springfield IL

If you or a loved one are going through bankruptcy then finding a bankruptcy lawyer in Springfield, IL is an important step. However, filing a bankruptcy does not always mean that you cannot resist the temptation of credit cards. There are many other reasons why bankruptcy may be the most favorable option out there for you. Many people want to avoid bankruptcy because of the myths that surround

Will declaring bankruptcy make my credit worse?

Yes, bankruptcy does affect a person’s credit score, however, these impacts won’t last forever. Depending on your circumstances, it may be strategic to take a hit to your credit score in order to get on the path to more secure financial footing in the future. Chapter 7 and Chapter 13 bankruptcies remain on a person’s credit report for 7-10 years. But, there is no reason to think that you cannot have strong credit after bankruptcy is over. While interest rates may be higher, it is possible to end up with better credit than when you first filed for bankruptcy.

Will I be debt-free if I file for bankruptcy?

Many people have the misconception that filing for bankruptcy means all of your debts will immediately be erased and you will start fresh with a clean slate. For most people, this just isn’t the case as bankruptcy filings are more complex than that. Only certain kinds of unsecured debts are to be discharged under bankruptcy, such as credit card debt, unsecured loans, and medical bills. Debts that won’t be eliminated through bankruptcy include child support, many student loans, alimony, and taxes. If you want to know whether bankruptcy is right for you, an Illinois bankruptcy lawyer in Springfield can provide you with a consultation.

Will I need to appear in court for bankruptcy?

Those who are filing for bankruptcy will probably have to attend a meeting with their creditors around a month after filing the initial petition paperwork. A trustee appointed by the court will interview the debtor to ensure that information on the bankruptcy petition and schedules are correct. But rest assured that your lawyer can guide you every step of the way, even when things feel overwhelming. It is our job to support you and provide legal information as your bankruptcy filing proceeds.

Call Pioletti Pioletti & Nichols today to schedule a consultation with a bankruptcy lawyer in Springfield, Illinois at your next earliest convenience.

FAQs About Bankruptcy Lawyers in Springfield, IL

Consulting with a Springfield IL bankruptcy lawyer can help you if you have debt and are considering bankruptcy. These legal professionals specialize in navigating the complexities of bankruptcy law and can guide you through the process. Let’s address five frequently asked questions about bankruptcy lawyers to help you understand their role and how they can assist you in your financial struggles.

What does a bankruptcy lawyer do?

A bankruptcy lawyer typically specializes in bankruptcy law and helps individuals and businesses either avoid bankruptcy or help them navigate the process. They provide expert advice and assistance throughout the entire bankruptcy procedure, including evaluating your financial situation, determining the most suitable bankruptcy chapter, preparing and filing the necessary paperwork, representing you in court hearings, and guiding you towards a fresh financial start.

Why do I need a bankruptcy lawyer?

Navigating the bankruptcy process can be a complex and overwhelming experience. A bankruptcy lawyer is essential because they have the knowledge and expertise to navigate the intricacies of bankruptcy laws and procedures. They will ensure that you meet all legal requirements, protect your rights, and maximize the benefits available to you. With their guidance, you can avoid common pitfalls, make informed decisions, and achieve the best possible outcome for your financial future.

Which bankruptcy chapter is right for me?

The most common types of bankruptcy chapters for individuals are Chapter 7 and Chapter 13. Chapter 7 bankruptcy is known as liquidation bankruptcy, where non-exempt assets are sold to pay off creditors, while Chapter 13 bankruptcy is a reorganization plan that allows you to repay debts over a period of time. The choice between these chapters depends on several factors, including your income, assets, debts, and financial goals. A bankruptcy lawyer will evaluate your situation and guide you in selecting the most appropriate chapter for your specific circumstances.

Will bankruptcy eliminate all my debts?

Bankruptcy can provide significant debt relief, but not all debts can be discharged. Certain types of debts, such as child support, alimony, most tax debts, and student loans, are generally not dischargeable in bankruptcy. However, bankruptcy can still help by eliminating or reducing unsecured debts like credit card debt, medical bills, and personal loans. A Springfield bankruptcy lawyer can help you determine what debts can be eliminated and which ones you’ll need to repay.

How do I choose the right bankruptcy lawyer in Springfield, IL?

Knowing how to choose the correct bankruptcy lawyer is vital to navigating the process. Start by seeking referrals from trusted sources or researching reputable bankruptcy attorneys in Springfield, IL. Look for attorneys with extensive experience in bankruptcy law and a track record of successful cases. Schedule consultations with a few lawyers to discuss your situation, ask about their fees and payment plans, and evaluate their level of expertise and communication skills. Ultimately, choose a lawyer who understands your unique circumstances, makes you feel comfortable, and demonstrates a genuine commitment to helping you achieve financial relief.

If you are considering bankruptcy as a solution to your financial struggles, consulting with a bankruptcy lawyer is essential. They have the expertise to guide you through the bankruptcy process, protect your rights, and help you achieve a fresh financial start. From determining the right bankruptcy chapter to handling the legal paperwork and representing you in court, a bankruptcy lawyer will be your advocate throughout the process. Take the time to research and choose an experienced bankruptcy attorney who understands your situation and can provide the necessary guidance and support. If you or a loved one needs a Springfield bankruptcy lawyer, reach out to our Pioletti Pioletti & Nichols team today!

Springfield Bankruptcy Lawyer Statistics

In the third quarter of 2022 alone, according to the United States Courts, there were over 2,227 bankruptcy cases filed in central Illinois. Bankruptcy is a drastic action but is a visible solution for certain types of financial peril. There are many reasons why people might need to file for bankruptcy. For many people bankruptcy is a tough decision and it can be a complicated one which is why a lawyer is there to help you through every step.

Unraveling Illinois Bankruptcy Laws: Your Guide To Financial Relief

In the city of Springfield, Illinois, financial difficulties can sometimes become overwhelming, leading individuals and businesses to explore bankruptcy as a means of relief by working with a Springfield, IL bankruptcy lawyer. Understanding the intricate framework of Illinois bankruptcy laws is essential when seeking a fresh start and financial stability. At Pioletti Pioletti & Nichols, our dedicated bankruptcy lawyers in Springfield are committed to providing expert legal guidance to clients. We are here to help you navigate the legal landscape and work towards a brighter financial future.

Bankruptcy In Illinois: An Overview

Bankruptcy is a federal legal process that allows individuals and businesses to discharge or restructure their debts under the protection of the bankruptcy court. While bankruptcy is a federal law, states like Illinois often have their own specific considerations and laws.

Types Of Bankruptcy In Illinois

Illinois residents and businesses can file for several types of bankruptcy, but the most common are Chapter 7 and Chapter 13:

- Chapter 7 Bankruptcy: This is often referred to as “liquidation bankruptcy” as it involves the sale of non-exempt assets to repay creditors. Unsecured debts like credit card debt and medical bills can be discharged under Chapter 7.

- Chapter 13 Bankruptcy: This is known as “reorganization bankruptcy” and allows individuals and businesses with a regular income to create a repayment plan to pay off their debts over a period of three to five years.

Illinois Bankruptcy Exemptions

Illinois law provides a list of property exemptions that a debtor can claim in bankruptcy to protect certain assets from being sold to repay creditors. Some common exemptions in Illinois include the homestead exemption for a primary residence, personal property exemptions, and exemptions for specific benefits like retirement accounts.

The Illinois Bankruptcy Means Test

To qualify for Chapter 7 bankruptcy in Illinois, individuals must pass the “means test.” This test evaluates your income and expenses to determine if you have the means to pay off your debts over time. When your income is below the state median, you may qualify for Chapter 7. If it’s above, you may need to consider Chapter 13.

Why You Need A Springfield Bankruptcy Lawyer

The role of a bankruptcy lawyer is vital in ensuring that your bankruptcy case proceeds smoothly and that your rights are protected. Ways a Springfield bankruptcy lawyer can help are:

- Legal Expertise: At Pioletti Pioletti & Nichols, our team of experienced bankruptcy lawyers has an in-depth understanding of Illinois bankruptcy laws. This knowledge enables us to provide expert guidance tailored to your specific case.

- Comprehensive Evaluation: We conduct a thorough review of your financial situation to determine the most suitable bankruptcy chapter for your needs. This step ensures maximized debt relief when assessing your assets.

- Assistance with Paperwork: Bankruptcy involves a significant amount of paperwork, and it can be easy to make a mistake. Our lawyers will help you complete the necessary documents accurately, reducing the risk of errors that could lead to complications in your case.

- Protection of Your Rights: Our attorneys ensure that your rights are upheld throughout the bankruptcy process. If necessary, we can represent you in court as well.

Contact Us Today

If you’re considering bankruptcy in Springfield, Illinois, don’t attempt to navigate the complex legal process alone. Reach out to Pioletti Pioletti & Nichols for a confidential consultation to discuss your case and receive expert legal counsel. Our experienced bankruptcy lawyers are here to guide you through the intricacies of Illinois bankruptcy laws and work towards a more stable financial future. Don’t face financial difficulties without the support of a dedicated legal team. Contact us today and take the first step towards financial relief when you work with a Springfield bankruptcy lawyer.

The Road To Financial Relief Starts Here

Bankruptcy can be a powerful tool for obtaining a fresh start. Contact us today to schedule a consultation with our Springfield bankruptcy lawyers. We will help you understand your options, make informed decisions, and take the first step towards financial stability. Your financial well-being is our priority, and we are committed to assisting you in achieving a brighter future.

Pioletti Pioletti & Nichols Springfield Bankruptcy Lawyer

Springfield, IL 62701

Client Review

“Joe did my bankruptcy case and he was awesome! He was with me every step of the way. His secretary, Lea, is also great! She was very helpful and followed up on some paperwork and saved me some time. Definitely recommended!”

Heather Thomas