Peoria Chapter 13 Bankruptcy Lawyer

Your Dedicated Chapter 13 Bankruptcy Attorney

Realizing that your debts vastly outweigh your earnings can be a stressful experience, and warrants contacting our Peoria, IL Chapter 13 bankruptcy lawyer as soon as possible. Bankruptcy could be a reliable option for you that puts you on a path to being more financially secure. While bankruptcy may or may not eliminate all of your debts, it certainly can offer benefits that can change the course of someone’s life for the better. Once we consult with you about your situation, we will be able to advise you on whether bankruptcy is the right choice or if there are other options to try first. For immediate bankruptcy assistance, contact Pioletti Pioletti & Nichols.

Table of Contents

-

- Your Dedicated Chapter 13 Bankruptcy Attorney

- Understanding Debt Resolution Through Chapter 13 Bankruptcy

- Peoria Chapter 13 Bankruptcy Infographic

- Peoria Chapter 13 Bankruptcy Statistics

- Peoria Chapter 13 Bankruptcy FAQs

- Pioletti Pioletti & Nichols, Peoria Chapter 13 Bankruptcy Lawyer

- Contact Our Peoria Chapter 13 Bankruptcy Lawyer Today

Eligibility for Chapter 13

Chapter 13 bankruptcy can be a favorable choice for those who are still able to repay a portion of their outstanding debts. Those who do not have enough earnings to pay back debts and are in search of complete financial relief may be better suited for a different bankruptcy chapter. We suggest contacting a Peoria Chapter 13 bankruptcy lawyer so we can let you know which chapter is most appropriate for your circumstances and if you are eligible to file. Under Chapter 13, a debtor will have to follow a repayment plan for about 3-5 years based on what they can afford. This gives someone the chance to reorganize their finances while having some debts discharged entirely.

The Process of Filing for Bankruptcy

Those who qualify for bankruptcy can file a petition to the bankruptcy court to get relief from debts. A trustee will be appointed by the court to oversee the process. The trustee will need to review information such as the debtor’s assets, liabilities, income, expenditures, and other financial details. You may not be eligible for Chapter 13 bankruptcy if you have filed for bankruptcy in the last 180 days and your case was dismissed because of a hearing absence or court order violation. If you received a discharge under Chapter 13 within the past 2 years this can affect your eligibility and more time will need to go by before you can file again. If you do not make enough disposable income, another chapter may be recommended. If you need to file for bankruptcy as a business, you may be eligible for Chapter 11 bankruptcy, which is designed for business owners.

Understanding Debt Resolution Through Chapter 13 Bankruptcy

Navigating the complexities of financial distress can be a daunting task. It’s a journey that often requires expert guidance to ensure the most favorable outcome. When individuals find themselves overwhelmed by debt, exploring certain legal options can provide a structured pathway to financial recovery. This process involves a unique approach to debt resolution that can be an advantageous solution for many facing financial hardship. A skilled Peoria, IL Chapter 13 bankruptcy lawyer from Pioletti Pioletti & Nichols would be happy to set up a consultation to go over your case in greater detail.

Financial Restructuring For Sustained Stability

Financial challenges come in various forms and magnitudes. This method offers a personalized approach to debt restructuring. It’s designed to cater to individuals with a regular income, enabling them to develop a plan to repay their debts over time. The process is not a one-size-fits-all solution; rather, it’s a tailored plan based on individual financial circumstances. This flexibility allows for a more manageable and realistic approach to debt repayment.

Situations Where This Approach Proves Beneficial

Certain scenarios make Chapter 13 bankruptcy particularly advantageous. Consider an individual with significant secured debts, such as a mortgage or car loan, who wishes to keep these assets. This process provides a framework to catch up on missed payments while retaining possession of the property. It’s also an ideal solution for those with a steady income but facing temporary financial distress due to unforeseen circumstances like medical emergencies or temporary unemployment.

Small Businesses That Need Help

For small business owners, this legal option can be a lifeline. It allows them to reorganize their personal debts while keeping their business operational. This is especially valuable for sole proprietors whose personal and business finances are closely intertwined. It will be crucial to speak with a Peoria Chapter 13 bankruptcy lawyer to assist with all of the necessary paperwork and decisions.

Manageable Payback Plans

Individuals with debts that are not dischargeable through other bankruptcy processes, such as certain tax obligations or student loans. While this method doesn’t erase these debts, it can provide a manageable plan to pay them over time, offering much-needed relief and structure.

Restructuring Debts

Chapter 13 is also beneficial for those who have already filed for bankruptcy but are seeking to restructure their debts due to changes in their financial situation. It offers a chance to modify their repayment plan to better suit their current circumstances.

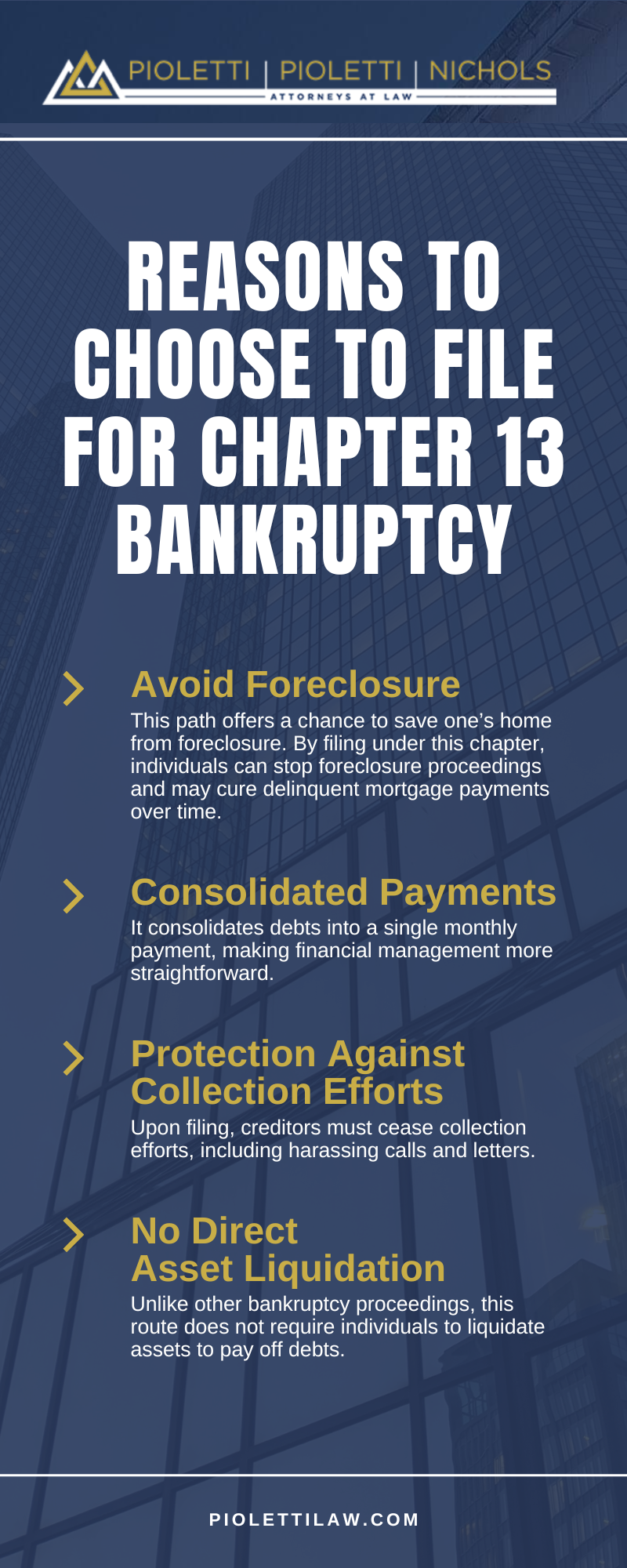

Peoria Chapter 13 Bankruptcy Infographic

Peoria Bankruptcy Statistics

According to the American Bankruptcy Institute, just under 400,000 people file for bankruptcy in the United States each year. There are approximately 157,000 Chapter 13 filers and 225,000 people who file for Chapter 7. Another 5,000 Chapter 11.

If you are struggling financially and considering filing, call our office to speak with a dedicated bankruptcy lawyer to learn which type of bankruptcy would benefit you the most.

Peoria Chapter 13 Bankruptcy FAQs

Filing for bankruptcy is a significant decision that impacts one’s financial future. Understanding the specifics of Chapter 13 repayment plans can help individuals make informed choices. This FAQ about a Peoria, IL Chapter 13 bankruptcy lawyer aims to shed light on common inquiries, offering clarity to those considering this path. Please reach out to Pioletti Pioletti & Nichols if you have other questions that could be answered, or if you want to set up a consultation.

What Is A Chapter 13 Repayment Plan?

A Chapter 13 repayment plan allows individuals with a steady income to develop a plan to repay all or part of their debts. Under this arrangement, debtors propose a repayment plan to make installments to creditors over three to five years.

Why Might Someone Choose This Financial Strategy?

There are many reasons that a person may choose to file for Chapter 13 bankruptcy. Here are some of the most common:

- Avoid Foreclosure: This path offers a chance to save one’s home from foreclosure. By filing under this chapter, individuals can stop foreclosure proceedings and may cure delinquent mortgage payments over time.

- Consolidated Payments: It consolidates debts into a single monthly payment, making financial management more straightforward.

- Protection Against Collection Efforts: Upon filing, creditors must cease collection efforts, including harassing calls and letters.

- No Direct Asset Liquidation: Unlike other bankruptcy proceedings, this route does not require individuals to liquidate assets to pay off debts.

When Might Chapter 13 Not Be The Best Course Of Action?

There are certain reasons that filing may not be a good decision, and a skilled Peoria Chapter 13 bankruptcy lawyer can be upfront with you about this. Some reasons include:

- Long-Term Impact on Credit: The effects of filing remain on a credit report for seven years, which can hinder the ability to obtain future credit.

- Commitment to a Lengthy Repayment Plan: Individuals must adhere to a three-to-five-year repayment schedule, which can be challenging for some to maintain.

- Not All Debts Can Be Discharged: Certain obligations, such as student loans, alimony, and child support, cannot be eliminated through this process.

- Legal and Administrative Costs: The process involves legal fees and court costs, which may add to financial strain.

How Does One Begin The Process Of Filing For Chapter 13?

Initiating the process requires compiling detailed documentation of income sources, major financial transactions, monthly living expenses, debts, and property. The next step is to consult a Peoria Chapter 13 bankruptcy lawyer to ensure this financial move aligns with personal circumstances and long-term goals.

Can Any Debt Be Included In The Plan?

Most types of debt can be included, but exceptions exist. Obligations such as alimony, child support, and certain taxes must still be paid in full. An attorney can provide detailed guidance on what can and cannot be included.

Is It Possible To Modify The Plan Once It’s In Place?

Yes, modifications to the plan are possible under certain circumstances, such as changes in income or expenses. However, any modification requires court approval.

What Happens Upon Completion Of The Plan?

Upon successful completion, most remaining dischargeable debts are eliminated. The individual emerges from the process with a fresh financial start, though the impact on credit and the obligation to pay any non-discharged debts remain.

Who Should Consider This Option?

Individuals facing overwhelming debt but wishing to avoid asset liquidation might find this option appealing. It’s suited for those with a regular income who can commit to a structured repayment plan.

Pioletti Pioletti & Nichols, Peoria Chapter 13 Bankruptcy Lawyer

401 Main St, Peoria, IL 61602

Contact Our Peoria Chapter 13 Bankruptcy Lawyer Today

Choosing to file for bankruptcy is a pivotal decision requiring careful consideration and professional guidance. If this path seems like it might be the right choice, consulting with a skilled Peoria Chapter 13 bankruptcy lawyer can provide the necessary insight and assistance to navigate the process effectively. Their expertise can help tailor a plan that aligns with personal financial goals, providing a structured path towards regaining financial stability. Reach out to Pioletti Pioletti & Nichols to learn more today.